Strategies

You can initilize a strategy by Python language.

There are many libraries that you can use for defining your trading strategy: you only have to choose what you like best. In these samples, the library used for trading strategy is Backtesting.py.

How to load indicators on your strategy

The best practice is to prepare one column for each indicator that you want to use on your strategy.

[1]:

!pip install pandas_datareader

# initialization

import numpy as np

import pandas as pd

from pandas_datareader import data as pdr

start='2017-10-30'

end='2020-10-08'

amzn = pdr.DataReader('AMZN', 'yahoo', start, end)

# simple indicators

amzn['SMA20'] = amzn['Close'].rolling(20).mean()

amzn['SMA50'] = amzn['Close'].rolling(50).mean()

amzn['EMA20'] = amzn['Close'].ewm(span=20, adjust=False).mean()

amzn['EMA50'] = amzn['Close'].ewm(span=50, adjust=False).mean()

amzn['STD20'] = amzn['Close'].rolling(20).std()

amzn['Upper Band'] = amzn['SMA20'] + (amzn['STD20'] * 2)

amzn['Lower Band'] = amzn['SMA20'] - (amzn['STD20'] * 2)

#amzn['Upper Band'] = amzn['EMA20'] + (amzn['STD20'] * 2)

#amzn['Lower Band'] = amzn['EMA20'] - (amzn['STD20'] * 2)

def RSI(data, time_window):

diff = data.diff(1).dropna()

up_chg = 0 * diff

down_chg = 0 * diff

up_chg[diff > 0] = diff[ diff>0 ]

down_chg[diff < 0] = diff[ diff < 0 ]

up_chg_avg = up_chg.ewm(com=time_window-1 , min_periods=time_window).mean()

down_chg_avg = down_chg.ewm(com=time_window-1 , min_periods=time_window).mean()

rs = abs(up_chg_avg/down_chg_avg)

rsi = 100 - 100/(1+rs)

return rsi

amzn['RSI'] = RSI(amzn['Close'], 14)

amzn['RSI70'] = 70.0

amzn['RSI50'] = 50.0

# custom indicator

def RSIaverage(data, n1, n2):

RSI_1 = RSI(data, n1)

RSI_2 = RSI(data, n2)

return (RSI_1 + RSI_2) / 2

amzn['RSIaverage'] = RSIaverage(amzn['Close'], 2, 14)

# data ranges

piece_d = pd.date_range(start='2017-10-30', end='2020-10-01')

#piece_d = pd.date_range(start='2020-01-01', end='2020-10-01')

amzn_piece_d = amzn.reindex(piece_d)

data = pd.DataFrame(amzn_piece_d.dropna())

# sample of divergence signal

divergence = [[('2020-07-22',3250),('2020-09-01',3550)]]

data['divergence'] = np.where((data.index == '2020-07-10') | (data.index == '2020-09-01'), data['RSI'], None)

data['divergence'] = data['divergence'].dropna()

Requirement already satisfied: pandas_datareader in /opt/conda/lib/python3.8/site-packages (0.9.0)

Requirement already satisfied: pandas>=0.23 in /opt/conda/lib/python3.8/site-packages (from pandas_datareader) (1.1.5)

Requirement already satisfied: requests>=2.19.0 in /opt/conda/lib/python3.8/site-packages (from pandas_datareader) (2.25.1)

Requirement already satisfied: lxml in /opt/conda/lib/python3.8/site-packages (from pandas_datareader) (4.6.2)

Requirement already satisfied: python-dateutil>=2.7.3 in /opt/conda/lib/python3.8/site-packages (from pandas>=0.23->pandas_datareader) (2.8.1)

Requirement already satisfied: pytz>=2017.2 in /opt/conda/lib/python3.8/site-packages (from pandas>=0.23->pandas_datareader) (2020.5)

Requirement already satisfied: numpy>=1.15.4 in /opt/conda/lib/python3.8/site-packages (from pandas>=0.23->pandas_datareader) (1.19.4)

Requirement already satisfied: six>=1.5 in /opt/conda/lib/python3.8/site-packages (from python-dateutil>=2.7.3->pandas>=0.23->pandas_datareader) (1.15.0)

Requirement already satisfied: urllib3<1.27,>=1.21.1 in /opt/conda/lib/python3.8/site-packages (from requests>=2.19.0->pandas_datareader) (1.26.2)

Requirement already satisfied: certifi>=2017.4.17 in /opt/conda/lib/python3.8/site-packages (from requests>=2.19.0->pandas_datareader) (2020.12.5)

Requirement already satisfied: idna<3,>=2.5 in /opt/conda/lib/python3.8/site-packages (from requests>=2.19.0->pandas_datareader) (2.10)

Requirement already satisfied: chardet<5,>=3.0.2 in /opt/conda/lib/python3.8/site-packages (from requests>=2.19.0->pandas_datareader) (4.0.0)

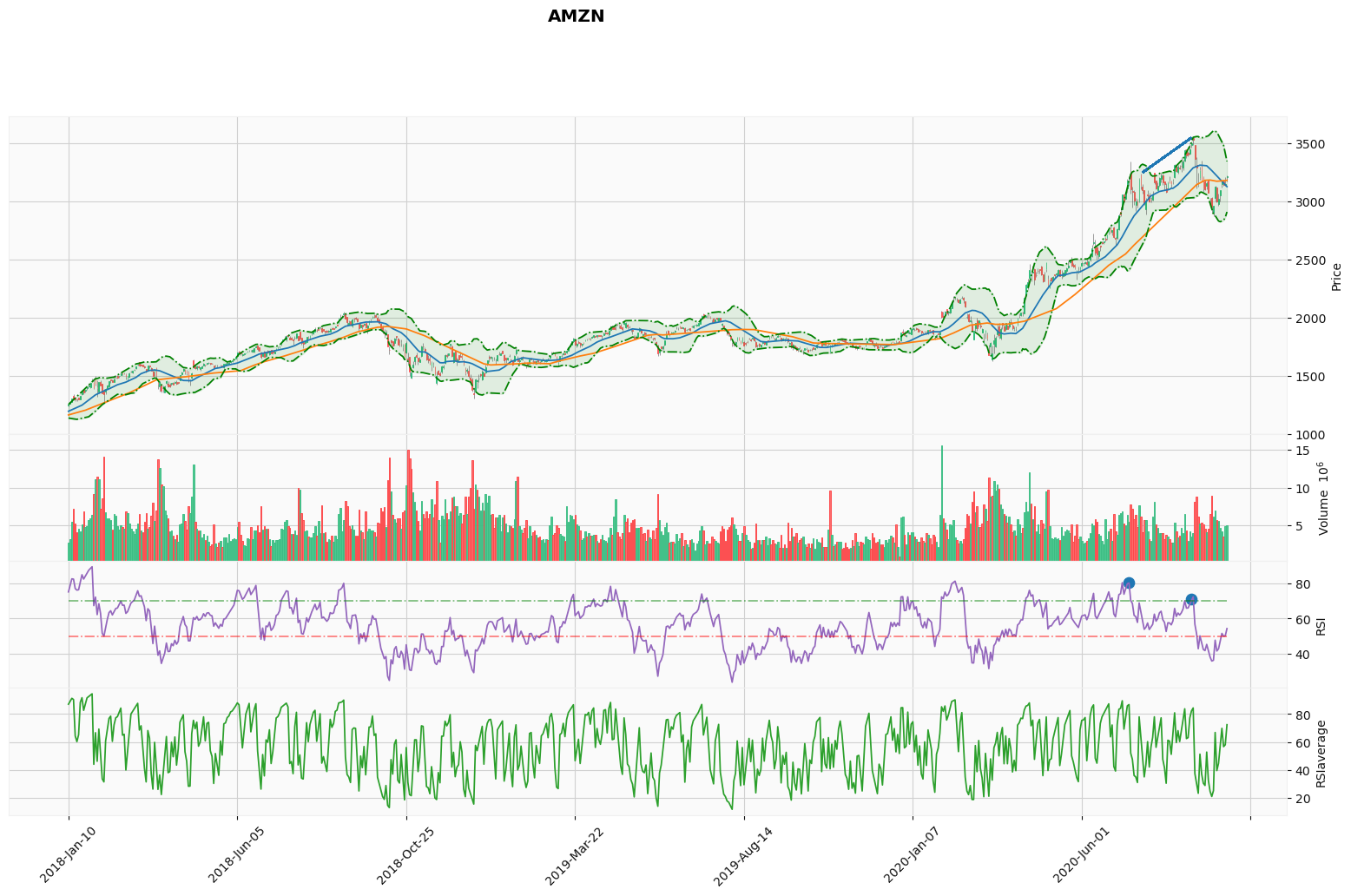

You can have to see your strategy and the plot is your solution. If you have not defined which indicators you want to use, you can see them all together.

[2]:

!pip install mplfinance

# plot with candle daily, sma 20, sma 50, bb, RSI and yahoo style

import mplfinance as mpf

kwargs = dict(type='candle',volume=True,figratio=(16,9),figscale=2)

aps = [

mpf.make_addplot(data['SMA20'],color='C0'), # blue

mpf.make_addplot(data['SMA50'],color='C1'), # orange

# mpf.make_addplot(data['EMA20'],color='C0'), # blue

# mpf.make_addplot(data['EMA50'],color='C1'), # orange

mpf.make_addplot(data['Upper Band'],linestyle='-.',color='g'),

mpf.make_addplot(data['Lower Band'],linestyle='-.',color='g'),

mpf.make_addplot(data['RSI'],color='C4',panel=2,ylabel='RSI'),

mpf.make_addplot(data['RSI70'],color='g',panel=2,type='line',linestyle='-.',alpha=0.5),

mpf.make_addplot(data['RSI50'],color='r',panel=2,type='line',linestyle='-.',alpha=0.5),

mpf.make_addplot(data['divergence'],color='C0',panel=2,type='scatter',markersize=78,marker='o'),

mpf.make_addplot(data['RSIaverage'],color='C2',panel=3,ylabel='RSIaverage'),

]

mpf.plot(data,**kwargs,style='yahoo',title='AMZN',addplot=aps,alines=divergence,fill_between=dict(y1=data['Lower Band'].values,y2=data['Upper Band'].values,alpha=0.1,color='g'))

#mpf.plot(data,**kwargs,style='yahoo',title='AMZN',addplot=aps,alines=divergence,fill_between=dict(y1=data['Lower Band'].values,y2=data['Upper Band'].values,alpha=0.1,color='g'),savefig=dict(fname='plot.with.candle.daily.sma.20.sma.50.bb.RSI.yahoo.style.png'))

Requirement already satisfied: mplfinance in /opt/conda/lib/python3.8/site-packages (0.12.7a4)

Requirement already satisfied: matplotlib in /opt/conda/lib/python3.8/site-packages (from mplfinance) (3.3.3)

Requirement already satisfied: pandas in /opt/conda/lib/python3.8/site-packages (from mplfinance) (1.1.5)

Requirement already satisfied: pyparsing!=2.0.4,!=2.1.2,!=2.1.6,>=2.0.3 in /opt/conda/lib/python3.8/site-packages (from matplotlib->mplfinance) (2.4.7)

Requirement already satisfied: pillow>=6.2.0 in /opt/conda/lib/python3.8/site-packages (from matplotlib->mplfinance) (8.0.1)

Requirement already satisfied: numpy>=1.15 in /opt/conda/lib/python3.8/site-packages (from matplotlib->mplfinance) (1.19.4)

Requirement already satisfied: python-dateutil>=2.1 in /opt/conda/lib/python3.8/site-packages (from matplotlib->mplfinance) (2.8.1)

Requirement already satisfied: cycler>=0.10 in /opt/conda/lib/python3.8/site-packages (from matplotlib->mplfinance) (0.10.0)

Requirement already satisfied: kiwisolver>=1.0.1 in /opt/conda/lib/python3.8/site-packages (from matplotlib->mplfinance) (1.3.1)

Requirement already satisfied: six in /opt/conda/lib/python3.8/site-packages (from cycler>=0.10->matplotlib->mplfinance) (1.15.0)

Requirement already satisfied: pytz>=2017.2 in /opt/conda/lib/python3.8/site-packages (from pandas->mplfinance) (2020.5)

How to load signals on your strategy

The best practice is to prepare one column for each signal that you want to use on your strategy. The strategy below use the moving averages that they are SMA and EMA. You can use one or the other.

Disclaimer

The strategies below are some simple samples for having an idea how to use the libraries: those strategies are for the educational purpose only. All investments and trading in the stock market involve risk: any decisions related to buying/selling of stocks or other financial instruments should only be made after a thorough research, backtesting, running in demo and seeking a professional assistance if required.

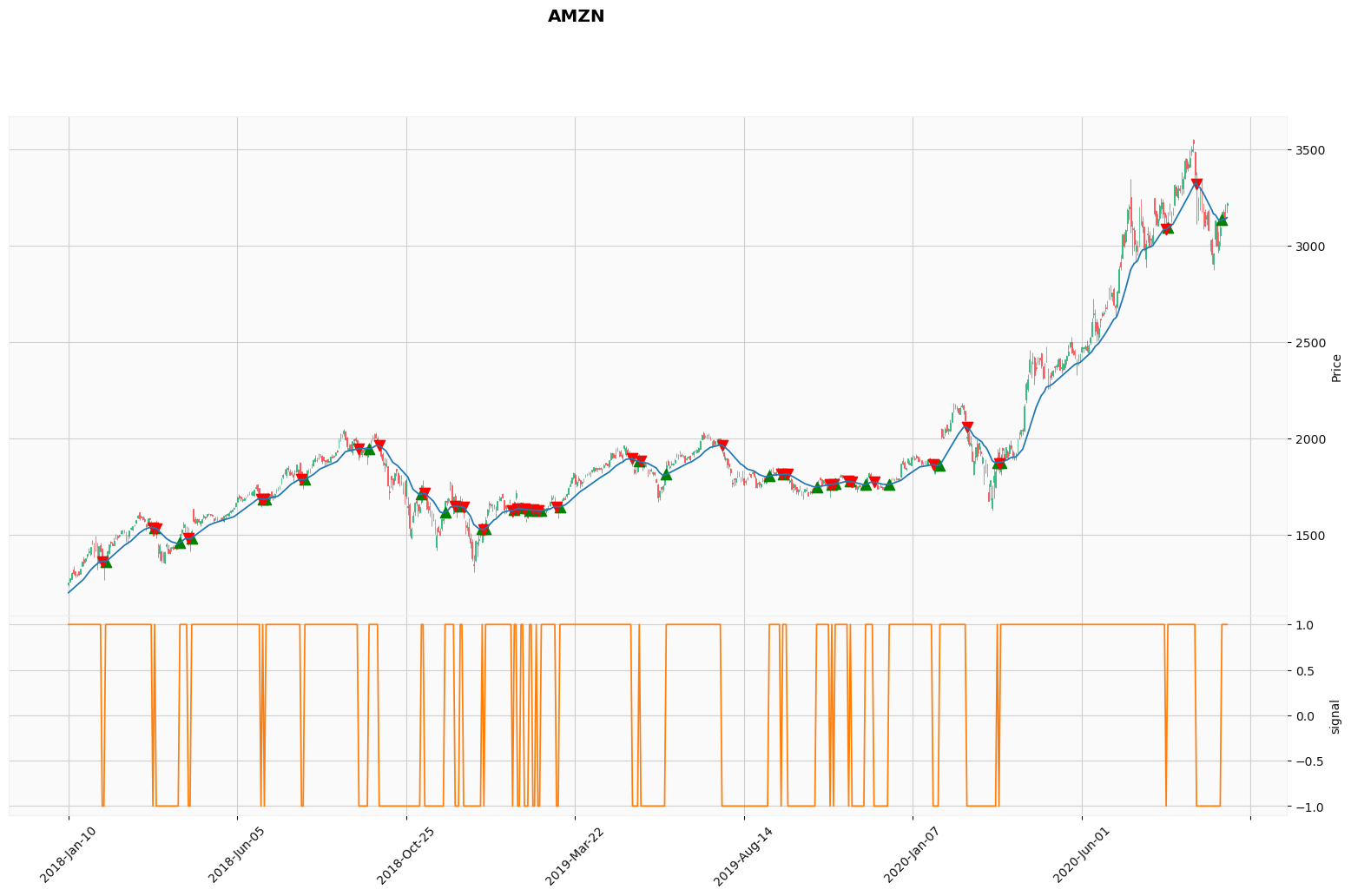

Moving Average Crossover Strategy - Sample 1

when the price value crosses the MA value from below, it will close any existing short position and go long (buy) one unit of the asset

when the price value crosses the MA value from above, it will close any existing long position and go short (sell) one unit of the asset

Reference: https://www.learndatasci.com/tutorials/python-finance-part-3-moving-average-trading-strategy/

[3]:

# Moving Average Crossover Strategy - Sample 1

#ma = 'SMA20'

ma = 'EMA20'

# Taking the difference between the prices and the MA timeseries

data['price_ma_diff'] = data['Close'] - data[ma]

# Taking the sign of the difference to determine whether the price or the EMA is greater

data['signal1'] = data['price_ma_diff'].apply(np.sign)

data['position1'] = data['signal1'].diff()

data['buy'] = np.where(data['position1'] == 2, data[ma], np.nan)

data['sell'] = np.where(data['position1'] == -2, data[ma], np.nan)

[4]:

# plot with candle daily, sma 20, signal and yahoo style

import mplfinance as mpf

kwargs = dict(type='candle',figratio=(16,9),figscale=2)

aps = [

mpf.make_addplot(data[ma],color='C0'), # blue

mpf.make_addplot(data['buy'],color='g',type='scatter',markersize=78,marker='^'),

mpf.make_addplot(data['sell'],color='r',type='scatter',markersize=78,marker='v'),

mpf.make_addplot(data['signal1'],color='C1',panel=1,ylabel='signal')

]

mpf.plot(data,**kwargs,style='yahoo',title='AMZN',addplot=aps)

#mpf.plot(data,**kwargs,style='yahoo',title='AMZN',addplot=aps,savefig=dict(fname='plot.with.candle.daily.sma.20.signal.yahoo.style.png'))

[5]:

!pip install backtesting

from backtesting import Backtest, Strategy

from backtesting.lib import crossover

from backtesting.test import SMA

class PositionSign(Strategy):

def init(self):

self.close = self.data.Close

def next(self):

i = len(self.data.Close) - 1

if self.data.position1[-1] == 2:

self.position.close()

self.buy()

elif self.data.position1[-1] == -2:

self.position.close()

self.sell()

bt = Backtest(data, PositionSign, cash=10000, commission=.002, exclusive_orders=True)

bt.run()

Requirement already satisfied: backtesting in /opt/conda/lib/python3.8/site-packages (0.3.0)

Requirement already satisfied: bokeh>=1.4.0 in /opt/conda/lib/python3.8/site-packages (from backtesting) (2.2.3)

Requirement already satisfied: numpy in /opt/conda/lib/python3.8/site-packages (from backtesting) (1.19.4)

Requirement already satisfied: pandas!=0.25.0,>=0.25.0 in /opt/conda/lib/python3.8/site-packages (from backtesting) (1.1.5)

Requirement already satisfied: python-dateutil>=2.1 in /opt/conda/lib/python3.8/site-packages (from bokeh>=1.4.0->backtesting) (2.8.1)

Requirement already satisfied: Jinja2>=2.7 in /opt/conda/lib/python3.8/site-packages (from bokeh>=1.4.0->backtesting) (2.11.2)

Requirement already satisfied: packaging>=16.8 in /opt/conda/lib/python3.8/site-packages (from bokeh>=1.4.0->backtesting) (20.8)

Requirement already satisfied: pillow>=7.1.0 in /opt/conda/lib/python3.8/site-packages (from bokeh>=1.4.0->backtesting) (8.0.1)

Requirement already satisfied: PyYAML>=3.10 in /opt/conda/lib/python3.8/site-packages (from bokeh>=1.4.0->backtesting) (5.3.1)

Requirement already satisfied: typing-extensions>=3.7.4 in /opt/conda/lib/python3.8/site-packages (from bokeh>=1.4.0->backtesting) (3.7.4.3)

Requirement already satisfied: tornado>=5.1 in /opt/conda/lib/python3.8/site-packages (from bokeh>=1.4.0->backtesting) (6.1)

Requirement already satisfied: MarkupSafe>=0.23 in /opt/conda/lib/python3.8/site-packages (from Jinja2>=2.7->bokeh>=1.4.0->backtesting) (1.1.1)

Requirement already satisfied: pyparsing>=2.0.2 in /opt/conda/lib/python3.8/site-packages (from packaging>=16.8->bokeh>=1.4.0->backtesting) (2.4.7)

Requirement already satisfied: pytz>=2017.2 in /opt/conda/lib/python3.8/site-packages (from pandas!=0.25.0,>=0.25.0->backtesting) (2020.5)

Requirement already satisfied: six>=1.5 in /opt/conda/lib/python3.8/site-packages (from python-dateutil>=2.1->bokeh>=1.4.0->backtesting) (1.15.0)

/opt/conda/lib/python3.8/site-packages/backtesting/_plotting.py:45: UserWarning: Jupyter Notebook detected. Setting Bokeh output to notebook. This may not work in Jupyter clients without JavaScript support (e.g. PyCharm, Spyder IDE). Reset with `backtesting.set_bokeh_output(notebook=False)`.

warnings.warn('Jupyter Notebook detected. '

[5]:

Start 2018-01-10 00:00:00

End 2020-10-01 00:00:00

Duration 995 days 00:00:00

Exposure Time [%] 96.9432

Equity Final [$] 6449.39

Equity Peak [$] 11361.5

Return [%] -35.5061

Buy & Hold Return [%] 156.811

Return (Ann.) [%] -14.8609

Volatility (Ann.) [%] 25.1543

Sharpe Ratio 0

Sortino Ratio 0

Calmar Ratio 0

Max. Drawdown [%] -62.3199

Avg. Drawdown [%] -17.0591

Max. Drawdown Duration 934 days 00:00:00

Avg. Drawdown Duration 238 days 00:00:00

# Trades 68

Win Rate [%] 25

Best Trade [%] 58.9442

Worst Trade [%] -12.944

Avg. Trade [%] -0.750267

Max. Trade Duration 141 days 00:00:00

Avg. Trade Duration 15 days 00:00:00

Profit Factor 0.790866

Expectancy [%] -0.473583

SQN -1.05025

_strategy PositionSign

_equity_curve ...

_trades Size EntryB...

dtype: object

[6]:

bt.plot()

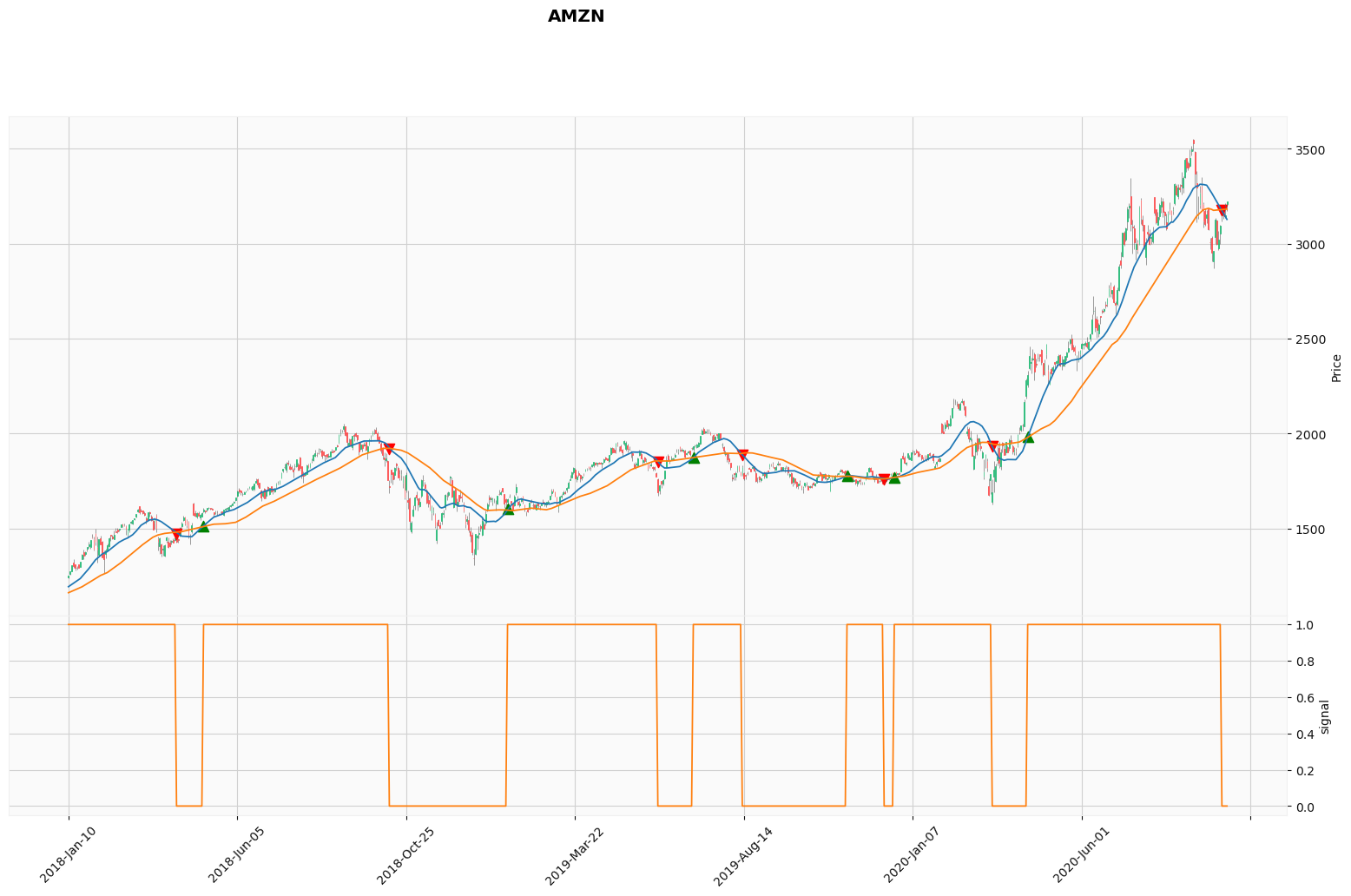

Moving Average Crossover Strategy - Sample 2

when the short term moving average crosses above the long term moving average, this indicates a buy signal

when the short term moving average crosses below the long term moving average, it may be a good moment to sell

[7]:

# Moving Average Crossover Strategy - Sample 2

ma20 = 'SMA20'

ma50 = 'SMA50'

#ma20 = 'EMA20'

#ma50 = 'EMA50'

data['signal2'] = 0.0

data['signal2'] = np.where(data[ma20] > data[ma50], 1.0, 0.0)

data['position2'] = data['signal2'].diff()

data['buy'] = np.where(data['position2'] == 1, data[ma20], np.nan)

data['sell'] = np.where(data['position2'] == -1, data[ma20], np.nan)

[8]:

# plot with candle daily, sma 20, sma 50, signal and yahoo style

import mplfinance as mpf

kwargs = dict(type='candle',figratio=(16,9),figscale=2)

aps = [

mpf.make_addplot(data[ma20],color='C0'), # blue

mpf.make_addplot(data[ma50],color='C1'), # orange

mpf.make_addplot(data['buy'],color='g',type='scatter',markersize=78,marker='^'),

mpf.make_addplot(data['sell'],color='r',type='scatter',markersize=78,marker='v'),

mpf.make_addplot(data['signal2'],color='C1',panel=1,ylabel='signal')

]

mpf.plot(data,**kwargs,style='yahoo',title='AMZN',addplot=aps)

#mpf.plot(data,**kwargs,style='yahoo',title='AMZN',addplot=aps,savefig=dict(fname='plot.with.candle.daily.sma.20.sma.50.signal.yahoo.style.png'))

[9]:

from backtesting import Backtest, Strategy

from backtesting.lib import crossover

from backtesting.test import SMA

class SmaCross(Strategy):

n1 = 20

n2 = 50

def init(self):

close = self.data.Close

self.sma1 = self.I(SMA, close, self.n1)

self.sma2 = self.I(SMA, close, self.n2)

def next(self):

if crossover(self.sma1, self.sma2):

self.position.close()

self.buy()

elif crossover(self.sma2, self.sma1):

self.position.close()

self.sell()

bt = Backtest(data, SmaCross, cash=10000, commission=.002, exclusive_orders=True)

bt.run()

[9]:

Start 2018-01-10 00:00:00

End 2020-10-01 00:00:00

Duration 995 days 00:00:00

Exposure Time [%] 90.5386

Equity Final [$] 7712.69

Equity Peak [$] 12532.8

Return [%] -22.8731

Buy & Hold Return [%] 156.811

Return (Ann.) [%] -9.08703

Volatility (Ann.) [%] 24.431

Sharpe Ratio 0

Sortino Ratio 0

Calmar Ratio 0

Max. Drawdown [%] -52.0307

Avg. Drawdown [%] -11.5153

Max. Drawdown Duration 517 days 00:00:00

Avg. Drawdown Duration 80 days 00:00:00

# Trades 13

Win Rate [%] 38.4615

Best Trade [%] 35.0832

Worst Trade [%] -32.3988

Avg. Trade [%] -2.23977

Max. Trade Duration 166 days 00:00:00

Avg. Trade Duration 70 days 00:00:00

Profit Factor 0.79924

Expectancy [%] -1.11657

SQN -0.620588

_strategy SmaCross

_equity_curve ...

_trades Size EntryB...

dtype: object

[10]:

bt.plot()