Strategies

You can initilize a strategy by R language.

The main libraries are

QuantStrat, for managing the strategy

PerformanceAnalytics, for performance and risk analysis

How to load indicators on your strategy

[1]:

#install.packages("quantmod")

#require(devtools)

#devtools::install_github("braverock/blotter")

#devtools::install_github("braverock/quantstrat")

[2]:

library(quantmod)

# initialization

Sys.setenv(TZ="UTC")

symbol = as.character("AMZN")

start <- as.Date("2017-01-01")

end <- as.Date("2020-01-01")

getSymbols(Symbols = symbol, src = "yahoo", from = start, to = end)

Loading required package: xts

Loading required package: zoo

Attaching package: ‘zoo’

The following objects are masked from ‘package:base’:

as.Date, as.Date.numeric

Loading required package: TTR

Registered S3 method overwritten by 'quantmod':

method from

as.zoo.data.frame zoo

‘getSymbols’ currently uses auto.assign=TRUE by default, but will

use auto.assign=FALSE in 0.5-0. You will still be able to use

‘loadSymbols’ to automatically load data. getOption("getSymbols.env")

and getOption("getSymbols.auto.assign") will still be checked for

alternate defaults.

This message is shown once per session and may be disabled by setting

options("getSymbols.warning4.0"=FALSE). See ?getSymbols for details.

[3]:

AMZN <- na.omit(lag(AMZN))

# calculate indicators

sma20 <- SMA(Cl(AMZN), n = 20)

ema20 <- EMA(Cl(AMZN), n = 20)

[4]:

library(quantstrat)

# strategy initialization

currency("USD")

stock(symbol, currency = 'USD', multiplier = 1)

tradeSize <- 100000

initEquity <- 100000

account.st <- portfolio.st <- strategy.st <- "my strategy"

rm.strat("my strategy")

out <- initPortf(portfolio.st, symbols = symbol, initDate = start, currency = "USD")

out <- initAcct(account.st, portfolios = portfolio.st, initDate = start, currency = "USD", initEq = initEquity)

initOrders(portfolio.st, initDate = start)

strategy(strategy.st, store = TRUE)

Loading required package: blotter

Loading required package: FinancialInstrument

Loading required package: PerformanceAnalytics

Attaching package: ‘PerformanceAnalytics’

The following object is masked from ‘package:graphics’:

legend

Loading required package: foreach

[5]:

# indicators with QuantStrat

out <- add.indicator(strategy.st, name = "SMA", arguments = list(x = quote(Cl(AMZN)), n = 20, maType = "SMA"), label = "SMA20periods")

out <- add.indicator(strategy.st, name = "SMA", arguments = list(x = quote(Cl(AMZN)), n = 50, maType = "SMA"), label = "SMA50periods")

out <- add.indicator(strategy.st, name = "EMA", arguments = list(x = quote(Cl(AMZN)), n = 20, maType = "EMA"), label = "EMA20periods")

out <- add.indicator(strategy.st, name = "EMA", arguments = list(x = quote(Cl(AMZN)), n = 50, maType = "EMA"), label = "EMA50periods")

out <- add.indicator(strategy.st, name = "RSI", arguments = list(price = quote(Cl(AMZN)), n = 7), label = "RSI720periods")

out <- add.indicator(strategy.st, name = "BBands", arguments = list(HLC = quote(Cl(AMZN)), n = 20, maType = "SMA", sd = 2), label = "Bollinger Bands")

[6]:

# custom indicator

RSIaverage <- function(price, n1, n2) {

RSI_1 <- RSI(price = price, n = n1)

RSI_2 <- RSI(price = price, n = n2)

calculatedAverage <- (RSI_1 + RSI_2) / 2

colnames(calculatedAverage) <- "RSI_average"

return(calculatedAverage)

}

out <- add.indicator(strategy.st, name = "RSIaverage", arguments = list(price = quote(Cl(AMZN)), n1 = 7, n2 = 14), label = "RSIaverage")

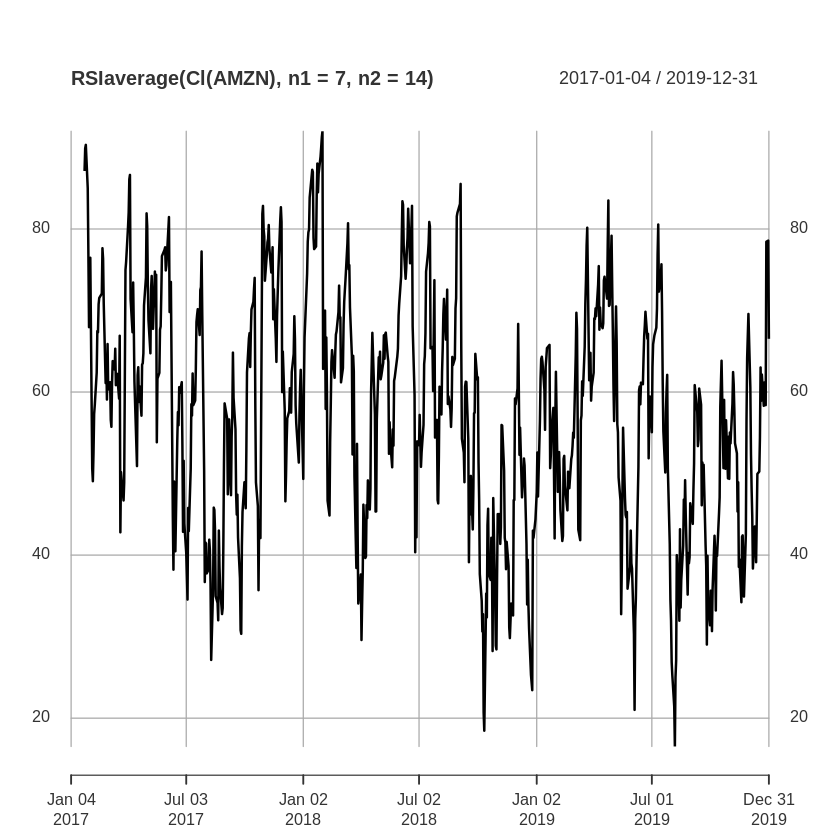

[7]:

# first tests

plot(RSIaverage(Cl(AMZN), n1=7, n2=14)) # for graphing your function results

[8]:

# load all indicators on my data

test <- applyIndicators(strategy = strategy.st, mktdata = OHLC(AMZN))

subsetTest <- test["2018-01-01/2019-01-01"]

head(subsetTest)

AMZN.Open AMZN.High AMZN.Low AMZN.Close SMA.SMA20periods

2018-01-02 1182.35 1184.00 1167.50 1169.47 1168.841

2018-01-03 1172.00 1190.00 1170.51 1189.01 1170.174

2018-01-04 1188.30 1205.49 1188.30 1204.20 1173.687

2018-01-05 1205.00 1215.87 1204.66 1209.59 1177.088

2018-01-08 1217.51 1229.14 1210.00 1229.14 1180.927

2018-01-09 1236.00 1253.08 1232.03 1246.87 1185.281

SMA.SMA50periods EMA.EMA20periods EMA.EMA50periods rsi.RSI720periods

2018-01-02 1129.739 1168.779 1130.025 44.92805

2018-01-03 1133.787 1170.706 1132.338 60.65982

2018-01-04 1138.213 1173.896 1135.156 68.75469

2018-01-05 1143.078 1177.295 1138.075 71.20734

2018-01-08 1148.143 1182.233 1141.646 78.38659

2018-01-09 1153.622 1188.389 1145.773 82.89832

dn.Bollinger.Bands mavg.Bollinger.Bands up.Bollinger.Bands

2018-01-02 1140.397 1168.841 1197.286

2018-01-03 1140.596 1170.174 1199.753

2018-01-04 1145.498 1173.687 1201.876

2018-01-05 1148.806 1177.088 1205.370

2018-01-08 1146.863 1180.927 1214.992

2018-01-09 1142.097 1185.281 1228.466

pctB.Bollinger.Bands RSI_average.RSIaverage

2018-01-02 0.5110476 49.34830

2018-01-03 0.8183989 60.54486

2018-01-04 1.0412143 66.72199

2018-01-05 1.0746036 68.64585

2018-01-08 1.2076629 74.50261

2018-01-09 1.2130873 78.45513

How to load signals on your strategy

The best practice is to prepare one column for each signal that you want to use on your strategy. The strategy below use the moving averages that they are SMA and EMA. You can use one or the other.

Disclaimer

The strategies below are some simple samples for having an idea how to use the libraries: those strategies are for the educational purpose only. All investments and trading in the stock market involve risk: any decisions related to buying/selling of stocks or other financial instruments should only be made after a thorough research, backtesting, running in demo and seeking a professional assistance if required.

Moving Average Crossover Strategy - Sample 1

when the price value crosses the MA value from below, it will close any existing short position and go long (buy) one unit of the asset

when the price value crosses the MA value from above, it will close any existing long position and go short (sell) one unit of the asset

Reference: https://www.learndatasci.com/tutorials/python-finance-part-3-moving-average-trading-strategy/

[9]:

# Moving Average Crossover Strategy - Sample 1

signalPosition <- function(price, ma) {

# Taking the difference between the prices and the MA timeseries

price_ma_diff <- price - ma

price_ma_diff[is.na(price_ma_diff)] <- 0 # replace missing signals with no position

# Taking the sign of the difference to determine whether the price or the MA is greater

position <- diff(price_ma_diff)

position[is.na(position)] <- 0 # replace missing signals with no position

colnames(position) <- "Signal_position"

return(position)

}

[10]:

#out <- add.indicator(strategy.st, name = "signalPosition", arguments = list(price = Cl(AMZN), ma = sma20), label = "signalPosition")

out <- add.indicator(strategy.st, name = "signalPosition", arguments = list(price = Cl(AMZN), ma = ema20), label = "signalPosition1")

out <- add.signal(strategy.st, name = "sigThreshold", arguments = list(column = "Signal_position", threshold = 2, relationship = "gte", cross = TRUE), label = "buy1")

out <- add.signal(strategy.st, name = "sigThreshold", arguments = list(column = "Signal_position", threshold = -2, relationship = "lte", cross = TRUE), label = "sell1")

#add.signal(strategy.st, name = "sigThreshold", arguments = list(data = position, column = "AMZN.Close", threshold = 2, relationship = "gte", cross = TRUE), label = "buy1")

#add.signal(strategy.st, name = "sigThreshold", arguments = list(data = position, column = "AMZN.Close", threshold = -2, relationship = "lte", cross = TRUE), label = "sell1")

# Creating rules

out <- add.rule(strategy.st, name = 'ruleSignal', arguments = list(sigcol = "buy1", sigval = TRUE, orderqty = 100, ordertype = 'market', orderside = 'long'), type = 'enter')

out <- add.rule(strategy.st, name = 'ruleSignal', arguments = list(sigcol = "sell1", sigval = TRUE, orderqty = 'all', ordertype = 'market', orderside = 'long'), type = 'exit')

#out <- add.rule(strategy.st, name = 'ruleSignal', arguments = list(sigcol = "sell1", sigval = TRUE, orderqty = -100, ordertype = 'market', orderside = 'short'), type = 'enter')

#out <- add.rule(strategy.st, name = 'ruleSignal', arguments = list(sigcol = "buy1", sigval = TRUE, orderqty = 'all', ordertype = 'market', orderside = 'short'), type = 'exit')

[11]:

# backtesting

applyStrategy(strategy.st, portfolios=portfolio.st)

out <- updatePortf(portfolio.st)

dateRange <- time(getPortfolio(portfolio.st)$summary)[-1]

out <- updateAcct(portfolio.st, dateRange)

out <- updateEndEq(account.st)

chart.Posn(portfolio.st, Symbol=symbol, TA=c("add_SMA(n=20,col='red')"))

[1] "2017-02-02 00:00:00 AMZN 100 @ 832.349976"

[1] "2017-02-07 00:00:00 AMZN -100 @ 807.640015"

[1] "2017-02-09 00:00:00 AMZN 100 @ 819.710022"

[1] "2017-02-14 00:00:00 AMZN 100 @ 836.530029"

[1] "2017-02-17 00:00:00 AMZN 100 @ 844.140015"

[1] "2017-02-23 00:00:00 AMZN 100 @ 855.609985"

[1] "2017-02-24 00:00:00 AMZN -400 @ 852.190002"

[1] "2017-03-01 00:00:00 AMZN 100 @ 845.039978"

[1] "2017-03-02 00:00:00 AMZN -100 @ 853.080017"

[1] "2017-03-03 00:00:00 AMZN 100 @ 848.909973"

[1] "2017-03-06 00:00:00 AMZN -100 @ 849.880005"

[1] "2017-03-10 00:00:00 AMZN 100 @ 853"

[1] "2017-03-16 00:00:00 AMZN -100 @ 852.969971"

[1] "2017-03-22 00:00:00 AMZN 100 @ 843.200012"

[1] "2017-03-23 00:00:00 AMZN -100 @ 848.059998"

[1] "2017-03-24 00:00:00 AMZN 100 @ 847.380005"

[1] "2017-03-30 00:00:00 AMZN 100 @ 874.320007"

[1] "2017-04-04 00:00:00 AMZN 100 @ 891.51001"

[1] "2017-04-06 00:00:00 AMZN 100 @ 909.280029"

[1] "2017-04-10 00:00:00 AMZN -400 @ 894.880005"

[1] "2017-04-12 00:00:00 AMZN 100 @ 902.359985"

[1] "2017-04-13 00:00:00 AMZN -100 @ 896.22998"

[1] "2017-04-19 00:00:00 AMZN 100 @ 903.780029"

[1] "2017-04-21 00:00:00 AMZN -100 @ 902.059998"

[1] "2017-04-26 00:00:00 AMZN 100 @ 907.619995"

[1] "2017-05-01 00:00:00 AMZN 100 @ 924.98999"

[1] "2017-05-04 00:00:00 AMZN -200 @ 941.030029"

[1] "2017-05-10 00:00:00 AMZN 100 @ 952.820007"

[1] "2017-05-12 00:00:00 AMZN -100 @ 947.619995"

[1] "2017-05-16 00:00:00 AMZN 100 @ 957.969971"

[1] "2017-05-17 00:00:00 AMZN -100 @ 966.070007"

[1] "2017-05-18 00:00:00 AMZN 100 @ 944.76001"

[1] "2017-05-19 00:00:00 AMZN -100 @ 958.48999"

[1] "2017-05-22 00:00:00 AMZN 100 @ 959.840027"

[1] "2017-05-24 00:00:00 AMZN 100 @ 971.539978"

[1] "2017-05-26 00:00:00 AMZN 100 @ 993.380005"

[1] "2017-06-01 00:00:00 AMZN -300 @ 994.619995"

[1] "2017-06-06 00:00:00 AMZN 100 @ 1011.340027"

[1] "2017-06-08 00:00:00 AMZN -100 @ 1010.070007"

[1] "2017-06-09 00:00:00 AMZN 100 @ 1010.27002"

[1] "2017-06-12 00:00:00 AMZN -100 @ 978.309998"

[1] "2017-06-15 00:00:00 AMZN 100 @ 976.469971"

[1] "2017-06-16 00:00:00 AMZN -100 @ 964.169983"

[1] "2017-06-20 00:00:00 AMZN 100 @ 995.169983"

[1] "2017-06-22 00:00:00 AMZN -100 @ 1002.22998"

[1] "2017-06-23 00:00:00 AMZN 100 @ 1001.299988"

[1] "2017-06-26 00:00:00 AMZN -100 @ 1003.73999"

[1] "2017-06-30 00:00:00 AMZN 100 @ 975.929993"

[1] "2017-07-03 00:00:00 AMZN -100 @ 968"

[1] "2017-07-07 00:00:00 AMZN 100 @ 965.140015"

[1] "2017-07-10 00:00:00 AMZN -100 @ 978.76001"

[1] "2017-07-11 00:00:00 AMZN 100 @ 996.469971"

[1] "2017-07-13 00:00:00 AMZN -100 @ 1006.51001"

[1] "2017-07-14 00:00:00 AMZN 100 @ 1000.630005"

[1] "2017-07-17 00:00:00 AMZN -100 @ 1001.809998"

[1] "2017-07-19 00:00:00 AMZN 100 @ 1024.449951"

[1] "2017-07-25 00:00:00 AMZN -100 @ 1038.949951"

[1] "2017-07-26 00:00:00 AMZN 100 @ 1039.869995"

[1] "2017-07-27 00:00:00 AMZN -100 @ 1052.800049"

[1] "2017-07-28 00:00:00 AMZN 100 @ 1046"

[1] "2017-07-31 00:00:00 AMZN -100 @ 1020.039978"

[1] "2017-08-03 00:00:00 AMZN 100 @ 995.890015"

[1] "2017-08-07 00:00:00 AMZN -100 @ 987.580017"

[1] "2017-08-08 00:00:00 AMZN 100 @ 992.27002"

[1] "2017-08-11 00:00:00 AMZN -100 @ 956.919983"

[1] "2017-08-15 00:00:00 AMZN 100 @ 983.299988"

[1] "2017-08-18 00:00:00 AMZN -100 @ 960.570007"

[1] "2017-08-24 00:00:00 AMZN 100 @ 958"

[1] "2017-08-25 00:00:00 AMZN -100 @ 952.450012"

[1] "2017-08-30 00:00:00 AMZN 100 @ 954.059998"

[1] "2017-09-06 00:00:00 AMZN -100 @ 965.27002"

[1] "2017-09-08 00:00:00 AMZN 100 @ 979.469971"

[1] "2017-09-12 00:00:00 AMZN -100 @ 977.960022"

[1] "2017-09-13 00:00:00 AMZN 100 @ 982.580017"

[1] "2017-09-18 00:00:00 AMZN -100 @ 986.789978"

[1] "2017-09-22 00:00:00 AMZN 100 @ 964.650024"

[1] "2017-09-25 00:00:00 AMZN -100 @ 955.099976"

[1] "2017-09-29 00:00:00 AMZN 100 @ 956.400024"

[1] "2017-10-06 00:00:00 AMZN 100 @ 980.849976"

[1] "2017-10-12 00:00:00 AMZN -200 @ 995"

[1] "2017-10-13 00:00:00 AMZN 100 @ 1000.929993"

[1] "2017-10-20 00:00:00 AMZN -100 @ 986.609985"

[1] "2017-10-26 00:00:00 AMZN 100 @ 972.909973"

[1] "2017-10-27 00:00:00 AMZN -100 @ 972.429993"

[1] "2017-10-31 00:00:00 AMZN 100 @ 1110.849976"

[1] "2017-11-02 00:00:00 AMZN -100 @ 1103.680054"

[1] "2017-11-07 00:00:00 AMZN 100 @ 1120.660034"

[1] "2017-11-09 00:00:00 AMZN -100 @ 1132.880005"

[1] "2017-11-10 00:00:00 AMZN 100 @ 1129.130005"

[1] "2017-11-13 00:00:00 AMZN -100 @ 1125.349976"

[1] "2017-11-16 00:00:00 AMZN 100 @ 1126.689941"

[1] "2017-11-17 00:00:00 AMZN -100 @ 1137.290039"

[1] "2017-11-20 00:00:00 AMZN 100 @ 1129.880005"

[1] "2017-11-21 00:00:00 AMZN -100 @ 1126.310059"

[1] "2017-11-24 00:00:00 AMZN 100 @ 1156.160034"

[1] "2017-11-30 00:00:00 AMZN -100 @ 1161.27002"

[1] "2017-12-04 00:00:00 AMZN 100 @ 1162.349976"

[1] "2017-12-05 00:00:00 AMZN -100 @ 1133.949951"

[1] "2017-12-07 00:00:00 AMZN 100 @ 1152.349976"

[1] "2017-12-13 00:00:00 AMZN 100 @ 1165.079956"

[1] "2017-12-14 00:00:00 AMZN -200 @ 1164.130005"

[1] "2017-12-18 00:00:00 AMZN 100 @ 1179.140015"

[1] "2017-12-21 00:00:00 AMZN -100 @ 1177.619995"

[1] "2017-12-28 00:00:00 AMZN 100 @ 1182.26001"

[1] "2018-01-03 00:00:00 AMZN -100 @ 1189.01001"

[1] "2018-01-04 00:00:00 AMZN 100 @ 1204.199951"

[1] "2018-01-09 00:00:00 AMZN 100 @ 1246.869995"

[1] "2018-01-12 00:00:00 AMZN -200 @ 1276.680054"

[1] "2018-01-16 00:00:00 AMZN 100 @ 1305.199951"

[1] "2018-01-18 00:00:00 AMZN -100 @ 1295"

[1] "2018-01-24 00:00:00 AMZN 100 @ 1362.540039"

[1] "2018-01-26 00:00:00 AMZN -100 @ 1377.949951"

[1] "2018-01-29 00:00:00 AMZN 100 @ 1402.050049"

[1] "2018-02-05 00:00:00 AMZN -100 @ 1429.949951"

[1] "2018-02-06 00:00:00 AMZN 100 @ 1390"

[1] "2018-02-07 00:00:00 AMZN -100 @ 1442.839966"

[1] "2018-02-08 00:00:00 AMZN 100 @ 1416.780029"

[1] "2018-02-09 00:00:00 AMZN -100 @ 1350.5"

[1] "2018-02-14 00:00:00 AMZN 100 @ 1414.51001"

[1] "2018-02-21 00:00:00 AMZN -100 @ 1468.349976"

[1] "2018-02-22 00:00:00 AMZN 100 @ 1482.920044"

[1] "2018-02-26 00:00:00 AMZN -100 @ 1500"

[1] "2018-02-27 00:00:00 AMZN 100 @ 1521.949951"

[1] "2018-03-01 00:00:00 AMZN -100 @ 1512.449951"

[1] "2018-03-06 00:00:00 AMZN 100 @ 1523.609985"

[1] "2018-03-13 00:00:00 AMZN 100 @ 1598.390015"

[1] "2018-03-15 00:00:00 AMZN -200 @ 1591"

[1] "2018-03-22 00:00:00 AMZN 100 @ 1581.859985"

[1] "2018-03-23 00:00:00 AMZN -100 @ 1544.920044"

[1] "2018-03-28 00:00:00 AMZN 100 @ 1497.050049"

[1] "2018-03-29 00:00:00 AMZN -100 @ 1431.420044"

[1] "2018-04-03 00:00:00 AMZN 100 @ 1371.98999"

[1] "2018-04-04 00:00:00 AMZN -100 @ 1392.050049"

[1] "2018-04-05 00:00:00 AMZN 100 @ 1410.569946"

[1] "2018-04-10 00:00:00 AMZN -100 @ 1406.079956"

[1] "2018-04-11 00:00:00 AMZN 100 @ 1436.219971"

[1] "2018-04-13 00:00:00 AMZN -100 @ 1448.5"

[1] "2018-04-16 00:00:00 AMZN 100 @ 1430.790039"

[1] "2018-04-17 00:00:00 AMZN -100 @ 1441.5"

[1] "2018-04-18 00:00:00 AMZN 100 @ 1503.829956"

[1] "2018-04-24 00:00:00 AMZN -100 @ 1517.859985"

[1] "2018-04-27 00:00:00 AMZN 100 @ 1517.959961"

[1] "2018-05-02 00:00:00 AMZN -100 @ 1582.26001"

[1] "2018-05-03 00:00:00 AMZN 100 @ 1569.680054"

[1] "2018-05-04 00:00:00 AMZN -100 @ 1572.079956"

[1] "2018-05-08 00:00:00 AMZN 100 @ 1600.140015"

[1] "2018-05-10 00:00:00 AMZN -100 @ 1608"

[1] "2018-05-11 00:00:00 AMZN 100 @ 1609.079956"

[1] "2018-05-14 00:00:00 AMZN -100 @ 1602.910034"

[1] "2018-05-18 00:00:00 AMZN 100 @ 1581.76001"

[1] "2018-05-21 00:00:00 AMZN -100 @ 1574.369995"

[1] "2018-05-23 00:00:00 AMZN 100 @ 1581.400024"

[1] "2018-05-24 00:00:00 AMZN -100 @ 1601.859985"

[1] "2018-05-25 00:00:00 AMZN 100 @ 1603.069946"

[1] "2018-05-30 00:00:00 AMZN 100 @ 1612.869995"

[1] "2018-06-01 00:00:00 AMZN 100 @ 1629.619995"

[1] "2018-06-05 00:00:00 AMZN 100 @ 1665.27002"

[1] "2018-06-08 00:00:00 AMZN -400 @ 1689.300049"

[1] "2018-06-14 00:00:00 AMZN 100 @ 1704.859985"

[1] "2018-06-18 00:00:00 AMZN 100 @ 1715.969971"

[1] "2018-06-19 00:00:00 AMZN -200 @ 1723.790039"

[1] "2018-06-21 00:00:00 AMZN 100 @ 1750.079956"

[1] "2018-06-25 00:00:00 AMZN -100 @ 1715.670044"

[1] "2018-06-28 00:00:00 AMZN 100 @ 1660.51001"

[1] "2018-06-29 00:00:00 AMZN -100 @ 1701.449951"

[1] "2018-07-02 00:00:00 AMZN 100 @ 1699.800049"

[1] "2018-07-03 00:00:00 AMZN -100 @ 1713.780029"

[1] "2018-07-05 00:00:00 AMZN 100 @ 1693.959961"

[1] "2018-07-06 00:00:00 AMZN -100 @ 1699.72998"

[1] "2018-07-09 00:00:00 AMZN 100 @ 1710.630005"

[1] "2018-07-13 00:00:00 AMZN 100 @ 1796.619995"

[1] "2018-07-19 00:00:00 AMZN 100 @ 1842.920044"

[1] "2018-07-20 00:00:00 AMZN -300 @ 1812.969971"

[1] "2018-07-26 00:00:00 AMZN 100 @ 1863.609985"

[1] "2018-07-30 00:00:00 AMZN -100 @ 1817.27002"

[1] "2018-07-31 00:00:00 AMZN 100 @ 1779.219971"

[1] "2018-08-01 00:00:00 AMZN -100 @ 1777.439941"

[1] "2018-08-03 00:00:00 AMZN 100 @ 1834.329956"

[1] "2018-08-07 00:00:00 AMZN -100 @ 1847.75"

[1] "2018-08-08 00:00:00 AMZN 100 @ 1862.47998"

[1] "2018-08-14 00:00:00 AMZN -100 @ 1896.199951"

[1] "2018-08-15 00:00:00 AMZN 100 @ 1919.650024"

[1] "2018-08-17 00:00:00 AMZN -100 @ 1886.52002"

[1] "2018-08-23 00:00:00 AMZN 100 @ 1904.900024"

[1] "2018-08-27 00:00:00 AMZN -100 @ 1905.390015"

[1] "2018-08-29 00:00:00 AMZN 100 @ 1932.819946"

[1] "2018-08-31 00:00:00 AMZN 100 @ 2002.380005"

[1] "2018-09-04 00:00:00 AMZN -200 @ 2012.709961"

[1] "2018-09-06 00:00:00 AMZN 100 @ 1994.819946"

[1] "2018-09-07 00:00:00 AMZN -100 @ 1958.310059"

[1] "2018-09-13 00:00:00 AMZN 100 @ 1990"

[1] "2018-09-17 00:00:00 AMZN -100 @ 1970.189941"

[1] "2018-09-20 00:00:00 AMZN 100 @ 1926.420044"

[1] "2018-09-21 00:00:00 AMZN -100 @ 1944.300049"

[1] "2018-09-24 00:00:00 AMZN 100 @ 1915.01001"

[1] "2018-09-25 00:00:00 AMZN -100 @ 1934.359985"

[1] "2018-09-26 00:00:00 AMZN 100 @ 1974.550049"

[1] "2018-09-28 00:00:00 AMZN -100 @ 2012.97998"

[1] "2018-10-01 00:00:00 AMZN 100 @ 2003"

[1] "2018-10-02 00:00:00 AMZN -100 @ 2004.359985"

[1] "2018-10-11 00:00:00 AMZN 100 @ 1755.25"

[1] "2018-10-12 00:00:00 AMZN -100 @ 1719.359985"

[1] "2018-10-16 00:00:00 AMZN 100 @ 1760.949951"

[1] "2018-10-17 00:00:00 AMZN -100 @ 1819.959961"

[1] "2018-10-18 00:00:00 AMZN 100 @ 1831.72998"

[1] "2018-10-22 00:00:00 AMZN -100 @ 1764.030029"

[1] "2018-10-23 00:00:00 AMZN 100 @ 1789.300049"

[1] "2018-10-25 00:00:00 AMZN -100 @ 1664.199951"

[1] "2018-10-29 00:00:00 AMZN 100 @ 1642.810059"

[1] "2018-10-30 00:00:00 AMZN -100 @ 1538.880005"

[1] "2018-11-01 00:00:00 AMZN 100 @ 1598.01001"

[1] "2018-11-07 00:00:00 AMZN -100 @ 1642.810059"

[1] "2018-11-08 00:00:00 AMZN 100 @ 1755.48999"

[1] "2018-11-12 00:00:00 AMZN -100 @ 1712.430054"

[1] "2018-11-19 00:00:00 AMZN 100 @ 1593.410034"

[1] "2018-11-20 00:00:00 AMZN -100 @ 1512.290039"

[1] "2018-11-26 00:00:00 AMZN 100 @ 1502.060059"

[1] "2018-11-27 00:00:00 AMZN -100 @ 1581.329956"

[1] "2018-11-28 00:00:00 AMZN 100 @ 1581.420044"

[1] "2018-12-03 00:00:00 AMZN -100 @ 1690.170044"

[1] "2018-12-04 00:00:00 AMZN 100 @ 1772.359985"

[1] "2018-12-07 00:00:00 AMZN -100 @ 1699.189941"

[1] "2018-12-10 00:00:00 AMZN 100 @ 1629.130005"

[1] "2018-12-11 00:00:00 AMZN -100 @ 1641.030029"

[1] "2018-12-12 00:00:00 AMZN 100 @ 1643.23999"

[1] "2018-12-17 00:00:00 AMZN -100 @ 1591.910034"

[1] "2018-12-20 00:00:00 AMZN 100 @ 1495.079956"

[1] "2018-12-21 00:00:00 AMZN -100 @ 1460.829956"

[1] "2018-12-28 00:00:00 AMZN 100 @ 1461.640015"

[1] "2019-01-02 00:00:00 AMZN 100 @ 1501.969971"

[1] "2019-01-07 00:00:00 AMZN -200 @ 1575.390015"

[1] "2019-01-08 00:00:00 AMZN 100 @ 1629.51001"

[1] "2019-01-11 00:00:00 AMZN -100 @ 1656.219971"

[1] "2019-01-17 00:00:00 AMZN 100 @ 1683.780029"

[1] "2019-01-23 00:00:00 AMZN -100 @ 1632.170044"

[1] "2019-01-25 00:00:00 AMZN 100 @ 1654.930054"

[1] "2019-01-30 00:00:00 AMZN -100 @ 1593.880005"

[1] "2019-02-01 00:00:00 AMZN 100 @ 1718.72998"

[1] "2019-02-05 00:00:00 AMZN -100 @ 1633.310059"

[1] "2019-02-06 00:00:00 AMZN 100 @ 1658.810059"

[1] "2019-02-08 00:00:00 AMZN -100 @ 1614.369995"

[1] "2019-02-13 00:00:00 AMZN 100 @ 1638.01001"

[1] "2019-02-19 00:00:00 AMZN -100 @ 1607.949951"

[1] "2019-02-21 00:00:00 AMZN 100 @ 1622.099976"

[1] "2019-02-22 00:00:00 AMZN -100 @ 1619.439941"

[1] "2019-02-26 00:00:00 AMZN 100 @ 1633"

[1] "2019-02-28 00:00:00 AMZN 100 @ 1641.089966"

[1] "2019-03-04 00:00:00 AMZN -200 @ 1671.72998"

[1] "2019-03-05 00:00:00 AMZN 100 @ 1696.170044"

[1] "2019-03-07 00:00:00 AMZN -100 @ 1668.949951"

[1] "2019-03-13 00:00:00 AMZN 100 @ 1673.099976"

[1] "2019-03-15 00:00:00 AMZN 100 @ 1686.219971"

[1] "2019-03-18 00:00:00 AMZN -200 @ 1712.359985"

[1] "2019-03-19 00:00:00 AMZN 100 @ 1742.150024"

[1] "2019-03-26 00:00:00 AMZN -100 @ 1774.26001"

[1] "2019-03-27 00:00:00 AMZN 100 @ 1783.76001"

[1] "2019-03-29 00:00:00 AMZN -100 @ 1773.420044"

[1] "2019-04-01 00:00:00 AMZN 100 @ 1780.75"

[1] "2019-04-04 00:00:00 AMZN -100 @ 1820.699951"

[1] "2019-04-09 00:00:00 AMZN 100 @ 1849.859985"

[1] "2019-04-11 00:00:00 AMZN -100 @ 1847.329956"

[1] "2019-04-12 00:00:00 AMZN 100 @ 1844.069946"

[1] "2019-04-15 00:00:00 AMZN -100 @ 1843.060059"

[1] "2019-04-18 00:00:00 AMZN 100 @ 1864.819946"

[1] "2019-04-22 00:00:00 AMZN -100 @ 1861.689941"

[1] "2019-04-24 00:00:00 AMZN 100 @ 1923.77002"

[1] "2019-04-26 00:00:00 AMZN -100 @ 1902.25"

[1] "2019-04-30 00:00:00 AMZN 100 @ 1938.430054"

[1] "2019-05-01 00:00:00 AMZN -100 @ 1926.52002"

[1] "2019-05-07 00:00:00 AMZN 100 @ 1950.550049"

[1] "2019-05-08 00:00:00 AMZN -100 @ 1921"

[1] "2019-05-16 00:00:00 AMZN 100 @ 1871.150024"

[1] "2019-05-21 00:00:00 AMZN -100 @ 1858.969971"

[1] "2019-05-24 00:00:00 AMZN 100 @ 1815.47998"

[1] "2019-05-28 00:00:00 AMZN -100 @ 1823.280029"

[1] "2019-05-29 00:00:00 AMZN 100 @ 1836.430054"

[1] "2019-05-31 00:00:00 AMZN -100 @ 1816.319946"

[1] "2019-06-06 00:00:00 AMZN 100 @ 1738.5"

[1] "2019-06-14 00:00:00 AMZN -100 @ 1870.300049"

[1] "2019-06-17 00:00:00 AMZN 100 @ 1869.670044"

[1] "2019-06-18 00:00:00 AMZN -100 @ 1886.030029"

[1] "2019-06-19 00:00:00 AMZN 100 @ 1901.369995"

[1] "2019-06-24 00:00:00 AMZN 100 @ 1911.300049"

[1] "2019-06-25 00:00:00 AMZN -200 @ 1913.900024"

[1] "2019-06-28 00:00:00 AMZN 100 @ 1904.280029"

[1] "2019-07-02 00:00:00 AMZN -100 @ 1922.189941"

[1] "2019-07-03 00:00:00 AMZN 100 @ 1934.310059"

[1] "2019-07-10 00:00:00 AMZN 100 @ 1988.300049"

[1] "2019-07-15 00:00:00 AMZN -200 @ 2011"

[1] "2019-07-24 00:00:00 AMZN 100 @ 1994.48999"

[1] "2019-07-29 00:00:00 AMZN -100 @ 1943.050049"

[1] "2019-08-08 00:00:00 AMZN 100 @ 1793.400024"

[1] "2019-08-13 00:00:00 AMZN -100 @ 1784.920044"

[1] "2019-08-15 00:00:00 AMZN 100 @ 1762.959961"

[1] "2019-08-16 00:00:00 AMZN -100 @ 1776.119995"

[1] "2019-08-19 00:00:00 AMZN 100 @ 1792.569946"

[1] "2019-08-22 00:00:00 AMZN -100 @ 1823.540039"

[1] "2019-08-23 00:00:00 AMZN 100 @ 1804.660034"

[1] "2019-08-26 00:00:00 AMZN -100 @ 1749.619995"

[1] "2019-08-28 00:00:00 AMZN 100 @ 1761.829956"

[1] "2019-08-30 00:00:00 AMZN 100 @ 1786.400024"

[1] "2019-09-04 00:00:00 AMZN -200 @ 1789.839966"

[1] "2019-09-05 00:00:00 AMZN 100 @ 1800.619995"

[1] "2019-09-10 00:00:00 AMZN -100 @ 1831.349976"

[1] "2019-09-16 00:00:00 AMZN 100 @ 1839.339966"

[1] "2019-09-17 00:00:00 AMZN -100 @ 1807.839966"

[1] "2019-09-19 00:00:00 AMZN 100 @ 1817.459961"

[1] "2019-09-20 00:00:00 AMZN -100 @ 1821.5"

[1] "2019-09-23 00:00:00 AMZN 100 @ 1794.160034"

[1] "2019-09-24 00:00:00 AMZN -100 @ 1785.300049"

[1] "2019-09-27 00:00:00 AMZN 100 @ 1739.839966"

[1] "2019-09-30 00:00:00 AMZN -100 @ 1725.449951"

[1] "2019-10-02 00:00:00 AMZN 100 @ 1735.650024"

[1] "2019-10-04 00:00:00 AMZN -100 @ 1724.420044"

[1] "2019-10-07 00:00:00 AMZN 100 @ 1739.650024"

[1] "2019-10-09 00:00:00 AMZN -100 @ 1705.51001"

[1] "2019-10-11 00:00:00 AMZN 100 @ 1720.26001"

[1] "2019-10-15 00:00:00 AMZN 100 @ 1736.430054"

[1] "2019-10-22 00:00:00 AMZN -200 @ 1785.660034"

[1] "2019-10-23 00:00:00 AMZN 100 @ 1765.72998"

[1] "2019-10-24 00:00:00 AMZN -100 @ 1762.170044"

[1] "2019-10-28 00:00:00 AMZN 100 @ 1761.329956"

[1] "2019-10-29 00:00:00 AMZN -100 @ 1777.079956"

[1] "2019-10-30 00:00:00 AMZN 100 @ 1762.709961"

[1] "2019-10-31 00:00:00 AMZN -100 @ 1779.98999"

[1] "2019-11-01 00:00:00 AMZN 100 @ 1776.660034"

[1] "2019-11-04 00:00:00 AMZN -100 @ 1791.439941"

[1] "2019-11-05 00:00:00 AMZN 100 @ 1804.660034"

[1] "2019-11-07 00:00:00 AMZN -100 @ 1795.77002"

[1] "2019-11-14 00:00:00 AMZN 100 @ 1753.109985"

[1] "2019-11-15 00:00:00 AMZN -100 @ 1754.599976"

[1] "2019-11-18 00:00:00 AMZN 100 @ 1739.48999"

[1] "2019-11-19 00:00:00 AMZN -100 @ 1752.530029"

[1] "2019-11-20 00:00:00 AMZN 100 @ 1752.790039"

[1] "2019-11-22 00:00:00 AMZN -100 @ 1734.709961"

[1] "2019-11-26 00:00:00 AMZN 100 @ 1773.839966"

[1] "2019-12-03 00:00:00 AMZN -100 @ 1781.599976"

[1] "2019-12-10 00:00:00 AMZN 100 @ 1749.51001"

[1] "2019-12-12 00:00:00 AMZN -100 @ 1748.719971"

[1] "2019-12-13 00:00:00 AMZN 100 @ 1760.329956"

[1] "2019-12-18 00:00:00 AMZN 100 @ 1790.660034"

[1] "2019-12-20 00:00:00 AMZN -200 @ 1792.280029"

[1] "2019-12-23 00:00:00 AMZN 100 @ 1786.5"

[1] "2019-12-24 00:00:00 AMZN -100 @ 1793"

[1] "2019-12-26 00:00:00 AMZN 100 @ 1789.209961"

[1] "2019-12-27 00:00:00 AMZN -100 @ 1868.77002"

[1] "2019-12-30 00:00:00 AMZN 100 @ 1869.800049"

[1] "2019-12-31 00:00:00 AMZN -100 @ 1846.890015"

[12]:

tstats <- tradeStats(portfolio.st, use="trades", inclZeroDays=FALSE)

data.frame(t(tstats))

| AMZN | |

|---|---|

| <chr> | |

| Portfolio | my strategy |

| Symbol | AMZN |

| Num.Txns | 348 |

| Num.Trades | 160 |

| Net.Trading.PL | 103829 |

| Avg.Trade.PL | 648.9312 |

| Med.Trade.PL | 194.4946 |

| Largest.Winner | 24637.02 |

| Largest.Loser | -12510.01 |

| Gross.Profits | 297592 |

| Gross.Losses | -193763 |

| Std.Dev.Trade.PL | 4650.819 |

| Std.Err.Trade.PL | 367.6795 |

| Percent.Positive | 53.125 |

| Percent.Negative | 46.875 |

| Profit.Factor | 1.535856 |

| Avg.Win.Trade | 3501.083 |

| Med.Win.Trade | 1707.996 |

| Avg.Losing.Trade | -2583.507 |

| Med.Losing.Trade | -1808.008 |

| Avg.Daily.PL | 648.9312 |

| Med.Daily.PL | 194.4947 |

| Std.Dev.Daily.PL | 4650.819 |

| Std.Err.Daily.PL | 367.6795 |

| Ann.Sharpe | 2.214979 |

| Max.Drawdown | -39630.02 |

| Profit.To.Max.Draw | 2.619958 |

| Avg.WinLoss.Ratio | 1.355167 |

| Med.WinLoss.Ratio | 0.9446838 |

| Max.Equity | 106120 |

| Min.Equity | -2470.996 |

| End.Equity | 103829 |

[13]:

#install.packages("magrittr") # package installations are only needed the first time you use it

#install.packages("dplyr") # alternative installation of the %>%

library(magrittr) # needs to be run every time you start R and want to use %>%

library(dplyr) # alternatively, this also loads %>%

trades <- tstats %>%

mutate(Trades = Num.Trades,

Win.Percent = Percent.Positive,

Loss.Percent = Percent.Negative,

WL.Ratio = Percent.Positive/Percent.Negative) %>%

select(Trades, Win.Percent, Loss.Percent, WL.Ratio)

data.frame(t(trades))

Attaching package: ‘dplyr’

The following objects are masked from ‘package:xts’:

first, last

The following objects are masked from ‘package:stats’:

filter, lag

The following objects are masked from ‘package:base’:

intersect, setdiff, setequal, union

| t.trades. | |

|---|---|

| <dbl> | |

| Trades | 160.000000 |

| Win.Percent | 53.125000 |

| Loss.Percent | 46.875000 |

| WL.Ratio | 1.133333 |

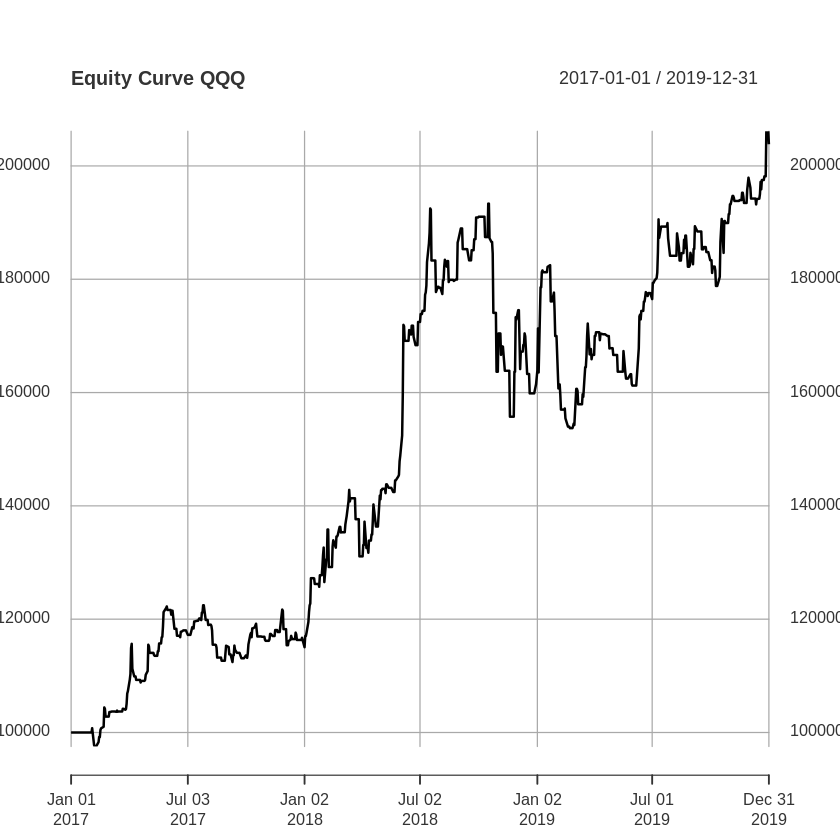

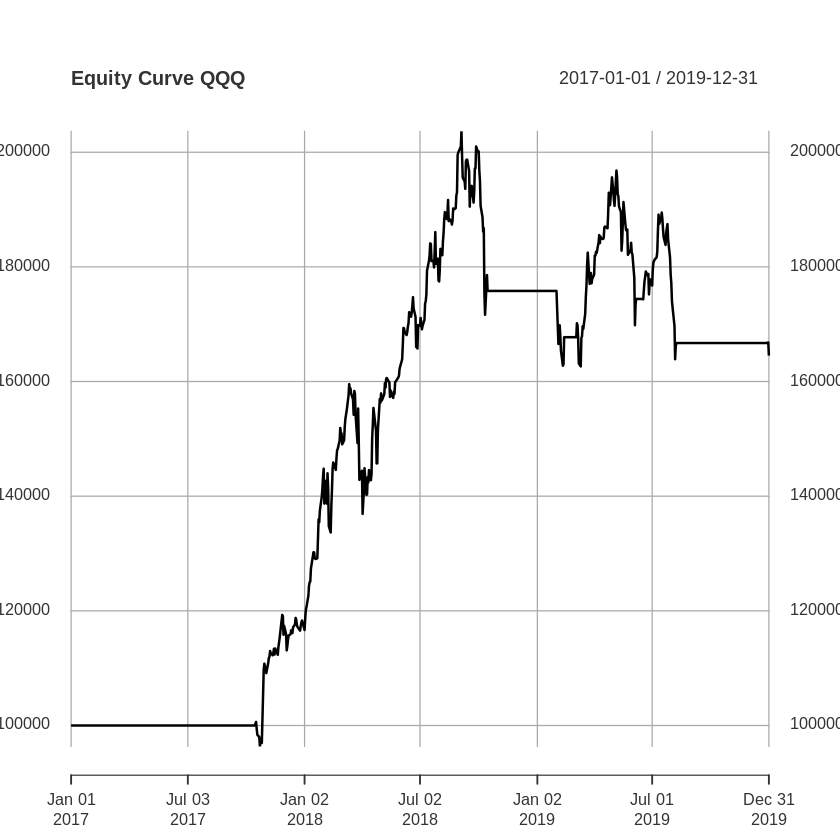

[14]:

a <- getAccount(account.st)

equity <- a$summary$End.Eq

plot(equity, main = "Equity Curve QQQ")

[15]:

portfolio <- getPortfolio(portfolio.st)

portfolioSummary <- portfolio$summary

colnames(portfolio$summary)

tail(portfolio$summary)

- 'Long.Value'

- 'Short.Value'

- 'Net.Value'

- 'Gross.Value'

- 'Period.Realized.PL'

- 'Period.Unrealized.PL'

- 'Gross.Trading.PL'

- 'Txn.Fees'

- 'Net.Trading.PL'

Long.Value Short.Value Net.Value Gross.Value Period.Realized.PL

2019-12-23 178650 0 178650 178650 0.000

2019-12-24 0 0 0 0 650.000

2019-12-26 178921 0 178921 178921 0.000

2019-12-27 0 0 0 0 7956.006

2019-12-30 186980 0 186980 186980 0.000

2019-12-31 0 0 0 0 -2291.003

Period.Unrealized.PL Gross.Trading.PL Txn.Fees Net.Trading.PL

2019-12-23 0 0.000 0 0.000

2019-12-24 0 650.000 0 650.000

2019-12-26 0 0.000 0 0.000

2019-12-27 0 7956.006 0 7956.006

2019-12-30 0 0.000 0 0.000

2019-12-31 0 -2291.003 0 -2291.003

[16]:

ret <- Return.calculate(equity, method = "log")

tail(ret)

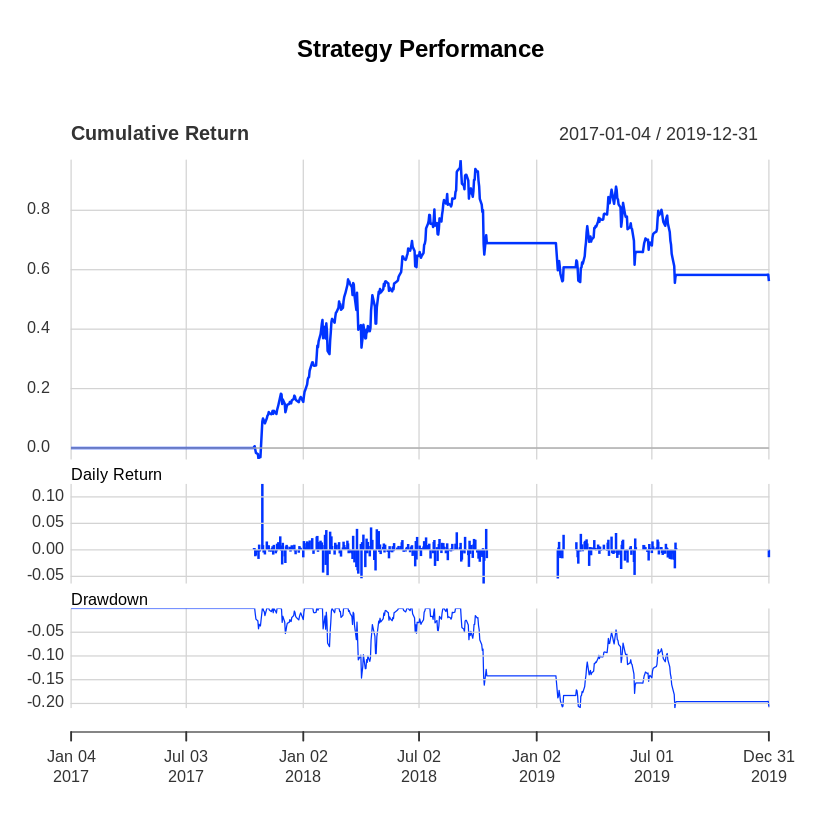

charts.PerformanceSummary(ret, colorset = bluefocus, main = "Strategy Performance")

End.Eq

2019-12-23 0.000000000

2019-12-24 0.003285503

2019-12-26 0.000000000

2019-12-27 0.039363582

2019-12-30 0.000000000

2019-12-31 -0.011177133

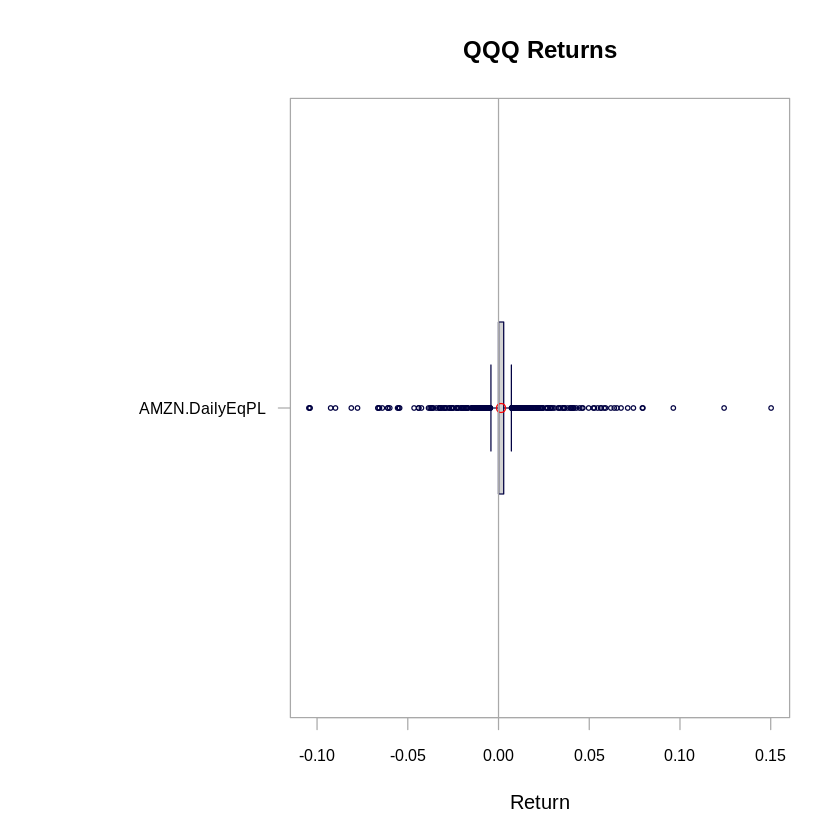

[17]:

rets <- PortfReturns(Account = account.st)

chart.Boxplot(rets, main = "QQQ Returns", colorset= rich10equal)

[18]:

table.Drawdowns(rets, top=10)

| From | Trough | To | Depth | Length | To Trough | Recovery |

|---|---|---|---|---|---|---|

| <date> | <date> | <date> | <dbl> | <dbl> | <dbl> | <dbl> |

| 2018-07-19 | 2019-02-22 | 2019-12-27 | -0.3726 | 364 | 150 | 214 |

| 2018-03-14 | 2018-03-29 | 2018-05-10 | -0.1135 | 41 | 12 | 29 |

| 2017-07-31 | 2017-09-11 | 2018-01-12 | -0.0966 | 116 | 30 | 86 |

| 2017-04-07 | 2017-04-20 | 2017-05-23 | -0.0671 | 32 | 9 | 23 |

| 2018-02-09 | 2018-02-09 | 2018-02-26 | -0.0663 | 11 | 1 | 10 |

| 2018-02-02 | 2018-02-02 | 2018-02-07 | -0.0609 | 4 | 1 | 3 |

| 2017-06-01 | 2017-06-21 | 2017-07-27 | -0.0535 | 40 | 15 | 25 |

| 2018-06-07 | 2018-06-25 | 2018-06-29 | -0.0362 | 17 | 13 | 4 |

| 2017-02-06 | 2017-02-07 | 2017-02-21 | -0.0322 | 11 | 2 | 9 |

| 2019-12-31 | 2019-12-31 | NA | -0.0229 | 2 | 1 | NA |

[19]:

table.CalendarReturns(rets)

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | AMZN.DailyEqPL | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| <dbl> | <dbl> | <dbl> | <dbl> | <dbl> | <dbl> | <dbl> | <dbl> | <dbl> | <dbl> | <dbl> | <dbl> | <dbl> | |

| 2017 | 0 | 0.0 | 0.4 | 0.9 | 0.3 | 0.0 | -2.6 | 1.4 | 0.0 | 0.0 | -3.2 | 0.4 | -2.6 |

| 2018 | 2 | -1.0 | -6.6 | 5.5 | 2.4 | 4.1 | 0.0 | 0.4 | 3.8 | 0.0 | -0.4 | 1.6 | 12.0 |

| 2019 | 0 | 0.5 | 0.8 | 0.0 | -0.3 | 0.0 | 0.0 | 2.2 | -1.4 | 1.7 | 2.2 | -2.3 | 3.3 |

[20]:

table.DownsideRisk(rets)

| AMZN.DailyEqPL | |

|---|---|

| <dbl> | |

| Semi Deviation | 0.0143 |

| Gain Deviation | 0.0208 |

| Loss Deviation | 0.0225 |

| Downside Deviation (MAR=210%) | 0.0177 |

| Downside Deviation (Rf=0%) | 0.0138 |

| Downside Deviation (0%) | 0.0138 |

| Maximum Drawdown | 0.3726 |

| Historical VaR (95%) | -0.0277 |

| Historical ES (95%) | -0.0528 |

| Modified VaR (95%) | -0.0264 |

| Modified ES (95%) | -0.0264 |

[21]:

table.Stats(rets)

| AMZN.DailyEqPL | |

|---|---|

| <dbl> | |

| Observations | 753.0000 |

| NAs | 0.0000 |

| Minimum | -0.1045 |

| Quartile 1 | 0.0000 |

| Median | 0.0000 |

| Arithmetic Mean | 0.0014 |

| Geometric Mean | 0.0012 |

| Quartile 3 | 0.0029 |

| Maximum | 0.1502 |

| SE Mean | 0.0007 |

| LCL Mean (0.95) | -0.0001 |

| UCL Mean (0.95) | 0.0028 |

| Variance | 0.0004 |

| Stdev | 0.0206 |

| Skewness | 0.2160 |

| Kurtosis | 11.3408 |

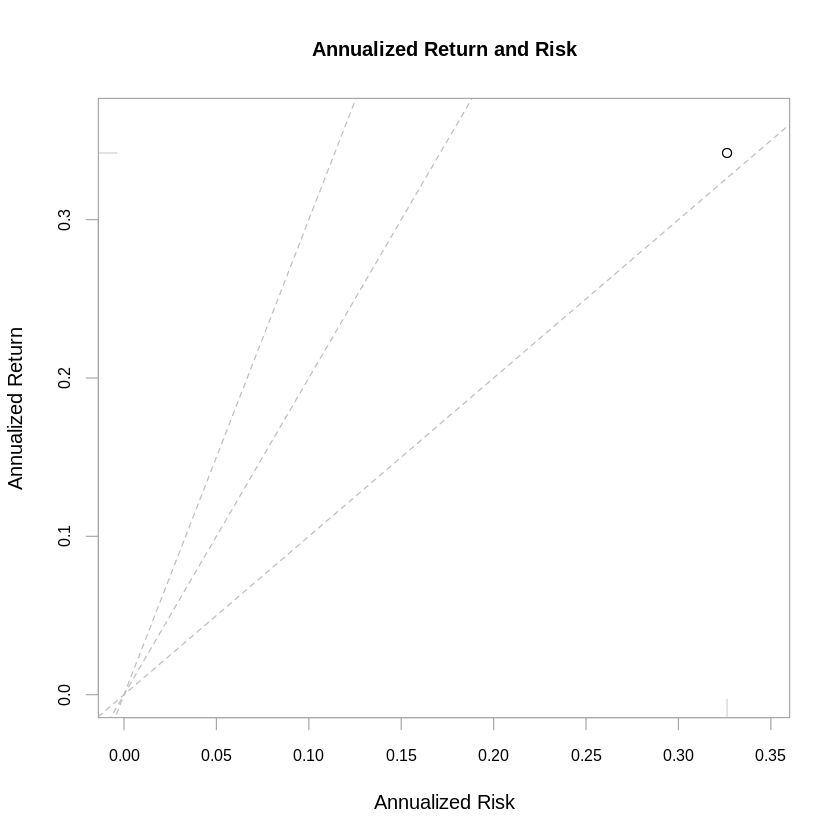

[22]:

chart.RiskReturnScatter(rets)

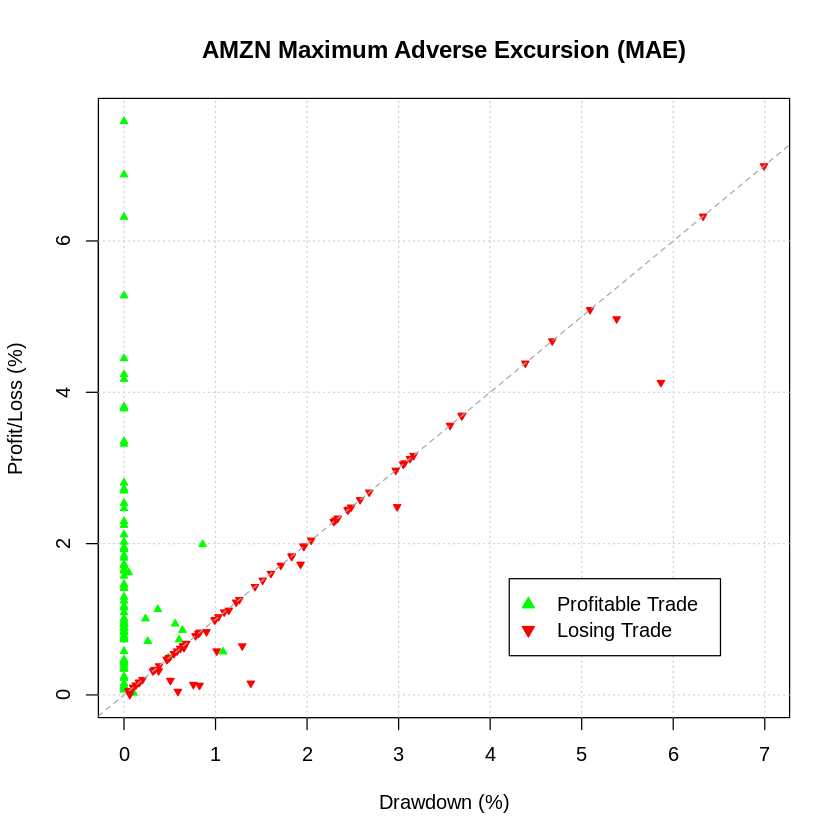

[23]:

chart.ME(Portfolio = portfolio.st, Symbol = symbol, type = "MAE", scale = "percent")

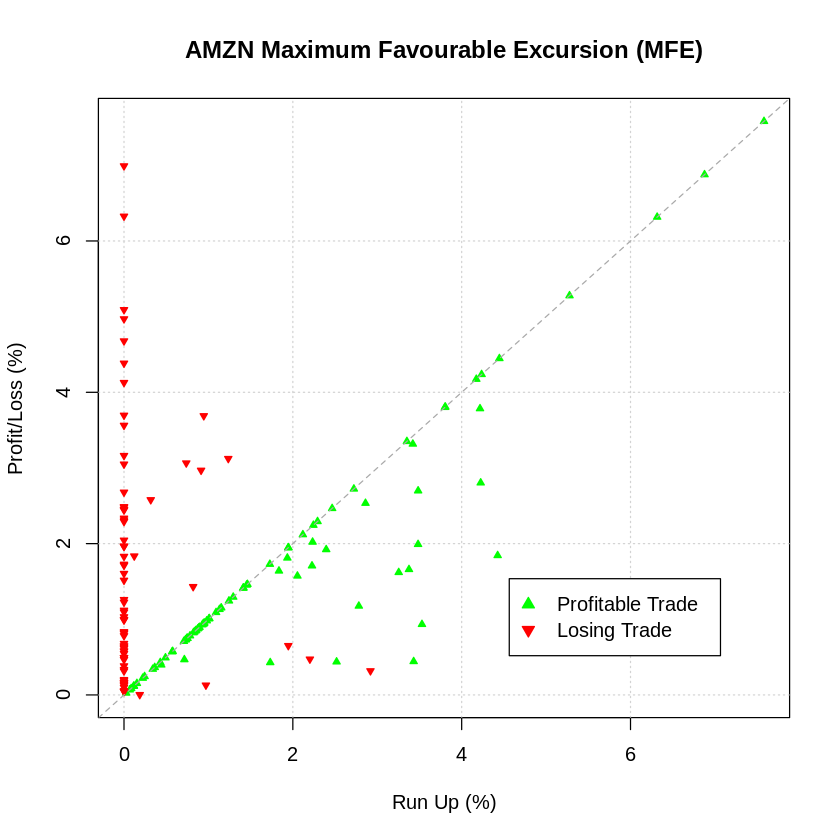

[24]:

chart.ME(Portfolio = portfolio.st, Symbol = symbol, type = "MFE", scale = "percent")

Moving Average Crossover Strategy - Sample 2

when the short term moving average crosses above the long term moving average, this indicates a buy signal

when the short term moving average crosses below the long term moving average, it may be a good moment to sell

[25]:

# Moving Average Crossover Strategy - Sample 2

# strategy resetting

rm.strat("my strategy")

out <- initPortf(portfolio.st, symbols = symbol, initDate = start, currency = "USD")

out <- initAcct(account.st, portfolios = portfolio.st, initDate = start, currency = "USD", initEq = initEquity)

initOrders(portfolio.st, initDate = start)

strategy(strategy.st, store = TRUE)

# Indicators

out <- add.indicator(strategy.st, name = "SMA", arguments = list(x = quote(Cl(AMZN)), n = 20, maType = "SMA"), label = "SMA20periods")

out <- add.indicator(strategy.st, name = "SMA", arguments = list(x = quote(Cl(AMZN)), n = 50, maType = "SMA"), label = "SMA50periods")

out <- add.indicator(strategy.st, name = "EMA", arguments = list(x = quote(Cl(AMZN)), n = 20, maType = "EMA"), label = "EMA20periods")

out <- add.indicator(strategy.st, name = "EMA", arguments = list(x = quote(Cl(AMZN)), n = 50, maType = "EMA"), label = "EMA50periods")

# Signals

#out <- add.signal(strategy.st, name = "sigCrossover", arguments = list(columns = c("SMA20periods", "SMA50periods"), relationship = "gte", cross = TRUE), label = "buy")

#out <- add.signal(strategy.st, name = "sigCrossover", arguments = list(columns = c("SMA20periods", "SMA50periods"), relationship = "lte", cross = TRUE), label = "sell")

out <- add.signal(strategy.st, name = "sigCrossover", arguments = list(columns = c("EMA20periods", "EMA50periods"), relationship = "gte", cross = TRUE), label = "buy2")

out <- add.signal(strategy.st, name = "sigCrossover", arguments = list(columns = c("EMA20periods", "EMA50periods"), relationship = "lte", cross = TRUE), label = "sell2")

# Rules

out <- add.rule(strategy.st, name = 'ruleSignal', arguments = list(sigcol = "buy2", sigval = TRUE, orderqty = 100, ordertype = 'market', orderside = 'long'), type = 'enter')

out <- add.rule(strategy.st, name = 'ruleSignal', arguments = list(sigcol = "sell2", sigval = TRUE, orderqty = 'all', ordertype = 'market', orderside = 'long'), type = 'exit')

#out <- add.rule(strategy.st, name = 'ruleSignal', arguments = list(sigcol = "sell2", sigval = TRUE, orderqty = -100, ordertype = 'market', orderside = 'short'), type = 'enter')

#out <- add.rule(strategy.st, name = 'ruleSignal', arguments = list(sigcol = "buy2", sigval = TRUE, orderqty = 'all', ordertype = 'market', orderside = 'short'), type = 'exit')

[26]:

# backtesting

applyStrategy(strategy.st, portfolios=portfolio.st)

out <- updatePortf(portfolio.st)

dateRange <- time(getPortfolio(portfolio.st)$summary)[-1]

out <- updateAcct(portfolio.st, dateRange)

out <- updateEndEq(account.st)

chart.Posn(portfolio.st, Symbol=symbol) #, TA=c("add_SMA(n=20,col='red')"))

[1] "2017-10-16 00:00:00 AMZN 100 @ 1002.940002"

[1] "2018-10-16 00:00:00 AMZN -100 @ 1760.949951"

[1] "2019-02-01 00:00:00 AMZN 100 @ 1718.72998"

[1] "2019-02-13 00:00:00 AMZN -100 @ 1638.01001"

[1] "2019-03-04 00:00:00 AMZN 100 @ 1671.72998"

[1] "2019-06-06 00:00:00 AMZN -100 @ 1738.5"

[1] "2019-06-14 00:00:00 AMZN 100 @ 1870.300049"

[1] "2019-08-08 00:00:00 AMZN -100 @ 1793.400024"

[1] "2019-12-27 00:00:00 AMZN 100 @ 1868.77002"

[27]:

tstats <- tradeStats(portfolio.st, use="trades", inclZeroDays=FALSE)

data.frame(t(tstats))

| AMZN | |

|---|---|

| <chr> | |

| Portfolio | my strategy |

| Symbol | AMZN |

| Num.Txns | 9 |

| Num.Trades | 5 |

| Net.Trading.PL | 64528 |

| Avg.Trade.PL | 12905.6 |

| Med.Trade.PL | -2188 |

| Largest.Winner | 75800.99 |

| Largest.Loser | -8071.997 |

| Gross.Profits | 82478 |

| Gross.Losses | -17950 |

| Std.Dev.Trade.PL | 35660.49 |

| Std.Err.Trade.PL | 15947.85 |

| Percent.Positive | 40 |

| Percent.Negative | 60 |

| Profit.Factor | 4.594874 |

| Avg.Win.Trade | 41239 |

| Med.Win.Trade | 41239 |

| Avg.Losing.Trade | -5983.333 |

| Med.Losing.Trade | -7690.003 |

| Avg.Daily.PL | 16679 |

| Med.Daily.PL | -506.5003 |

| Std.Dev.Daily.PL | 40007.96 |

| Std.Err.Daily.PL | 20003.98 |

| Ann.Sharpe | 6.617956 |

| Max.Drawdown | -41021 |

| Profit.To.Max.Draw | 1.573048 |

| Avg.WinLoss.Ratio | 6.892312 |

| Med.WinLoss.Ratio | 5.362677 |

| Max.Equity | 103657 |

| Min.Equity | -3664.001 |

| End.Equity | 64528 |

[28]:

#install.packages("magrittr") # package installations are only needed the first time you use it

#install.packages("dplyr") # alternative installation of the %>%

#library(magrittr) # needs to be run every time you start R and want to use %>%

#library(dplyr) # alternatively, this also loads %>%

trades <- tstats %>%

mutate(Trades = Num.Trades,

Win.Percent = Percent.Positive,

Loss.Percent = Percent.Negative,

WL.Ratio = Percent.Positive/Percent.Negative) %>%

select(Trades, Win.Percent, Loss.Percent, WL.Ratio)

data.frame(t(trades))

| t.trades. | |

|---|---|

| <dbl> | |

| Trades | 5.0000000 |

| Win.Percent | 40.0000000 |

| Loss.Percent | 60.0000000 |

| WL.Ratio | 0.6666667 |

[29]:

a <- getAccount(account.st)

equity <- a$summary$End.Eq

plot(equity, main = "Equity Curve QQQ")

[30]:

ret <- Return.calculate(equity, method = "log")

charts.PerformanceSummary(ret, colorset = bluefocus, main = "Strategy Performance")

[31]:

rets <- PortfReturns(Account = account.st)

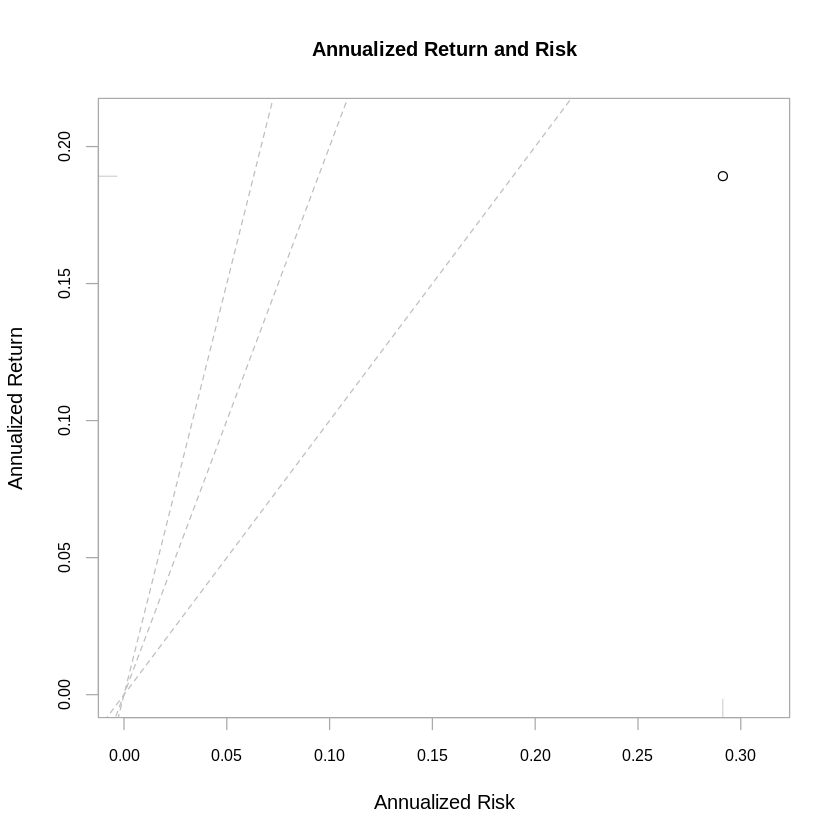

chart.RiskReturnScatter(rets)